Plan for Financial Fitness

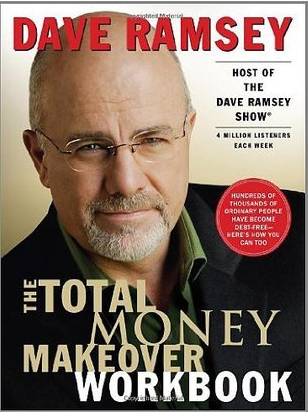

Author and radio personality Dave Ramsey, a financial expert, is the author of the personal finance book Total Money Makeover. It offers helpful tips and resources for achieving financial success.

The concept of the “debt snowball ” which refers to a strategy of paying off debt by starting with the lowest bill and working your way up to the highest debt, is introduced at the beginning of the book. This strategy works well because it enables the debtor to settle smaller obligations and gain momentum for larger obligations.

Dave Ramsey also stresses the significance of setting up and adhering to a budget. Additionally, he advises against high-risk investments and suggests diversifying one’s portfolio and investing in mutual funds.

The book’s main takeaway is the value of self-control and discipline in money management. In order to achieve financial freedom, it exhorts readers to take charge of their finances and make wise financial decisions.

Dave Ramsey

American author, radio host, television host, and motivational speaker Dave Ramsey specialises in personal finance. He is the author of numerous books on personal finance, including “The Total Money Makeover,” a best-seller that has aided millions of people in enhancing their financial circumstances.

The three pillars of “living on a budget,” “saving for emergencies and long-term objectives,” and “getting out of debt” make up Ramsey’s financial philosophy. In addition to encouraging individuals to prepare for long-term objectives like retirement and children’s education, he promotes living within one’s means and avoiding consumer debt.

Since 1992, Ramsey has served as the host of “The Dave Ramsey Show,” a radio programme that is nationally syndicated. He offers listeners financial guidance and responds to their personal finance queries on the programme. The Dave Ramsey Show, a chat show type television programme he also hosts, features Ramsey and a panel of professionals debating personal finance and investment issues.

The Super Saving

The concept of hyper saving is the foundation of Total Money Makeover. If you don’t save money first, you’ll spend it before you can replace it. Prioritize putting money into your savings account and saving it before using it to cover expenses.

The book also advises that you create financial objectives to give your funds something to work toward. You should, for instance, establish financial objectives like saving for a down payment on a home or creating an emergency fund. This will keep you inspired and on schedule with your financial goals.

The author also exhorts you to save for various kinds of expenses rather than just the major ones. You should set aside money for both major and minor expenses, such as buying a new car or going on vacation, as well as unanticipated costs.

Additionally, you’ll discover how crucial it is to make a budget in order to manage your finances and achieve your savings targets. The book suggests allocating funds for several areas, such as housing, food, and entertainment, using a budgeting strategy like the “envelope system.” You may track exactly where your money is going and make adjustments to meet your financial objectives by making a budget.

The Debt Snowball

You can learn how to manage your money and get out of debt in this StoryShot. The author underlines that paying off debt is a prerequisite for creating wealth.

The “debt snowball” strategy entails making the minimum payments on your higher obligations while paying off your smaller debts in ascending order of decreasing balance. You will make minimum payments on the higher obligations while paying off each loan one at a time, beginning with the lowest. The idea behind this strategy is that by making quick progress on minor bills, you’ll be inspired to keep working on your larger debts.

While focusing on paying off existing debt, avoid taking on additional debt. This will assist you in staying on course and helping you get closer to debt freedom.

The author also advises you to make as many cost-cutting measures as you can. As a result, money will be made available for debt repayment.

Prior to investing, it’s critical to establish an emergency money. According to the book, having 3-6 months’ worth of living expenses set up in an emergency fund can enable you to handle unforeseen bills without resorting to credit cards or loans.

The Emergency Fund for Three to Six Months

This StoryShot aims to educate you on the value of having an emergency fund and equip you with the techniques and resources you need to start saving for one. Prior to investing, you must have an emergency fund. It serves as the basis for your financial strategy.

With the help of an emergency fund, you may avoid using credit cards or loans to pay for unforeseen needs like auto repairs or urgent medical care.

- Save three to six months’ worth of living expenses as a reserve.

- Keep your emergency fund in an accessible savings account, like an internet savings account.

- Make sure your emergency fund is always fully funded by reviewing it frequently and making necessary adjustments.

- Prior to beginning to invest or pay off debt, begin saving for an emergency fund as soon as you can and make it a top priority.

- Avoid spending your emergency fund for non-essential expenses by keeping it distinct from your other savings.

- To make saving easier and more regular, think about setting up an automated transfer to your emergency fund account.

Putting the Debt-Free Money to Work

For your future, you must invest; this is the secret to accumulating riches. A return on your investment is what you want to achieve when you invest your money in assets like stocks, bonds, or real estate.

The book suggests that you put aside 15% of your salary for retirement investments. Employer matches are included in a Roth IRA, conventional IRA, or 401(k) (k). This will make it more likely that you will have enough cash to live comfortably in your later years.

The author also advises that you diversify your investments to reduce risk, such as by buying a combination of stocks, bonds, and real estate.

Spreading your money throughout various asset classes is known as diversification. By doing this, you can reduce the impact of a bad investment on your portfolio as a whole. Select low-cost index funds rather than expensive investment products and fees, such as mutual funds with high expense ratios.

Long-term investment strategy

Invest with a long-term plan rather than trying to time the market. An investor should concentrate on creating a diverse portfolio of assets that will perform well over the long-term rather than trying to predict short-term market changes.

A long-term investing strategy entails establishing clear objectives, such as retirement savings, and developing a plan to get there. It also entails periodically assessing and making necessary adjustments to your investments to make sure they remain in line with your objectives.

College Funding

As soon as you can, you should begin setting money aside for your children’s college expenses. Starting early with your savings will help you be able to afford the escalating cost of a higher education.

The book suggests that you invest for your children’s college education using a tax-advantaged college savings plan, such as a 529 plan. You can receive tax advantages while saving money for education.

The author also recommends that you involve your kids in the saving process. by encouraging them to save for their own educational expenses and educating them on the value of saving money.

Set priorities for other financial objectives, such as debt repayment and retirement savings, and be realistic about the amount you can afford to save for college.

Paying Off the Home Mortgage

Your mortgage should be paid off as soon as you can. You can become debt-free and have more money to invest in other aspects of your life by paying off your mortgage early.

In order to pay off your mortgage more quickly, the book suggests making additional payments, such as biweekly instalments. By making more than the required minimum payment, you can lower your overall interest costs and ultimately speed up the repayment of your mortgage.

If it makes sense financially, such as if you can get a cheaper interest rate or shorter term, refinance your mortgage to save money on interest and pay it off sooner.

Focus on paying off your mortgage as quickly as you can rather than taking on other debt, such as credit card charges.

The Big Misconception

The author dispels popular myths about money and money management, and she offers advice on how to keep your financial freedom. One of the main points is that living within your means is essential for achieving financial success. Living within your means is preferable to doing so. You can accumulate wealth and reach your financial goals by spending less than you make and saving the difference.

As your salary rises, try to avoid lifestyle inflation, which happens when you spend more money. By maintaining the same standard of living as your salary rises and investing the additional funds in the stock market, retirement savings, or debt repayment.

To stay on track and keep your financial freedom, you need have a solid financial support system that consists of creating a budget, setting aside money for emergencies, and developing a spending strategy.

The author also advises avoiding the “get rich quick” mentality and concentrating on accumulating wealth through regular and methodical saving.

Dave Ramsey wrote a book about personal finance called The Total Money Makeover. It offers helpful tips and resources for achieving financial success. The idea of the “debt snowball” strategy, in which you pay off debt by starting with the smallest debt and working your way up to the largest, is introduced at the beginning of the book.

In addition, Dave Ramsey stresses the value of developing and adhering to a budget, putting away three to six months’ worth of spending in a savings account for unplanned expenses, investing in mutual funds, and diversifying one’s investments.

In order to reach financial freedom, Dave Ramsey exhorts readers to take charge of their finances and make wise financial decisions.

If you really like this [the total money makeover book summary] by Growthex then you can also check out some more amazing posts which is freely available on this platform :

- The 4 Hour Body Book Summary By Tim Ferriss

- The Hard Thing About Hard Things by Ben Horowitz Book Summary

- Everything Is Fucked Book Summary Mark Manson

- Sell Like Crazy Book Summary by Sabri Suby

- The Lean Startup Book Summary By Eric Ries

Categories

To Watch great book summary explanation videos in Hindi language then visit : THIS YOUTUBE CHANNEL

Get the most out of every book you read. Growthex.org provides free, high quality summaries of books to help you make the most of your reading time.

Unlocking the power of knowledge, one book at a time. Growthex.org – the home for free, high-quality book summaries. Learn something new today.