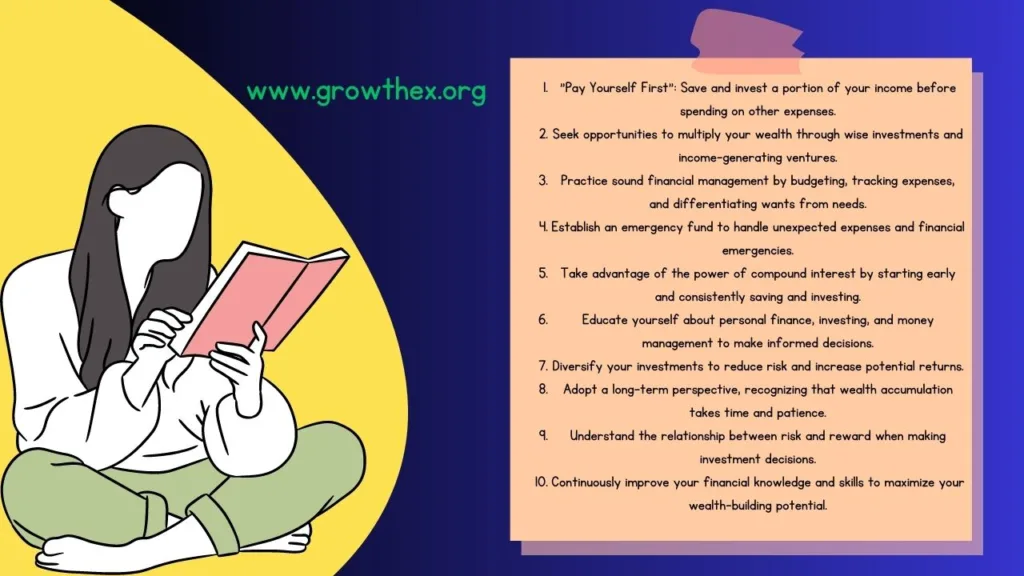

“The Richest Man in Babylon” by George S. Clason is a timeless personal finance classic that provides valuable lessons on building wealth and achieving financial success. Here are three important lessons from the book:

Pay Yourself First

The significance of setting aside some of your money for savings and investing before paying other bills is emphasised by this basic personal finance theory. Here are some crucial ideas to comprehend regarding this idea:

Priorities Saving: The goal is to priorities saving a percentage of your money as soon as you start receiving it, whether it comes in the form of a paycheck or another type of revenue. This entails saving a certain percentage or sum of money before you pay bills, buy food, enjoy yourself, or incur other costs. By prioritising saving, you can make sure that your money is spent on increasing your wealth rather than just covering short-term expenses.

Automate Your Savings: Automating your savings is a practical approach to put the “Pay Yourself First” idea into practice. Put a separate savings or investment account up for automatic transfers from your checking account. In this manner, a predetermined sum of money is automatically taken out before you ever have the opportunity to spend it. Automation gets rid of the incentive to skip or cut back on savings contributions and creates a disciplined strategy for accumulating wealth.

Create an Emergency Fund: Building an emergency fund is one of the main justifications for paying yourself first. A sum of money set aside for unforeseen costs or monetary emergencies is known as an emergency fund. It serves as a safety net, preventing you from turning to debt or encountering financial difficulties when unforeseen circumstances occur. You can steadily develop an emergency fund that offers security and peace of mind by continuously setting aside a portion of your salary.

Utilize Compound Interest: You can benefit from compound interest by paying yourself first and persistently saving money over time. Compound interest is the capacity of your savings or investments to generate interest on both the principal amount and the interest accrued over time. You can attain long-term financial goals by starting early and making regular deposits to your savings or investment accounts, which allows your money to grow tremendously.

Create a Wealth Mindset: “Pay Yourself First” focuses on creating a mindset that prioritises wealth development and financial security rather than just the act of saving money. You develop a mindset that emphasises long-term financial well-being by seeing your savings as a non-negotiable expense. You may match your activities with your financial objectives by adopting this mindset while you make deliberate decisions about your spending, saving, and investing.

In conclusion, “Pay Yourself First” is a powerful financial strategy that recommends setting aside and making investments using a percentage of your income prior to paying other bills. It urges you to set financial priorities for the long term, accumulate an emergency fund, and take advantage of compound interest.

Seek Opportunities to Multiply Your Wealth

In the line “Seek Opportunities to Multiply Your Wealth” from “The Richest Man in Babylon,” it is emphasized how crucial it is to actively seek out and take advantage of possibilities that could increase your fortune. Here are some crucial ideas to comprehend regarding this idea:

Investment attitude: Having an investment attitude is crucial if you want to increase your wealth. This entails changing your attention from passively saving money to actively looking for ways to increase it. The book urges readers to consider alternatives to typical savings accounts, including starting a business, investing in stocks or real estate, or developing transferable skills that can boost their earning potential.

Educate Yourself: It’s important to familiarize yourself with your possibilities before pursuing any investment opportunity. Spend some time learning about risk management, investing fundamentals, and the particular investment vehicles you are thinking about. You may make more confident and knowledgeable investing selections by increasing your knowledge and becoming more educated.

Diversification is one of the most important methods for increasing wealth. This entails distributing your investments across various businesses, geographies, or asset classes. By lessening the effect of the performance of a single investment on your whole portfolio, diversification helps to reduce risks. Your investment portfolio’s potential for development and the severity of any prospective losses are both increased by diversifying it.

A long-term perspective is necessary while looking for opportunities to increase wealth. It’s crucial to understand that building wealth requires patience and time. While certain investments may go through ups and downs or brief setbacks, by keeping an eye on the long term, you can ride out market cycles and possibly gain from compounding growth over time.

Risk and Reward: It’s critical to comprehend how risk and reward are related when looking for ways to increase wealth. bigger risks frequently accompany bigger potential gains. You must determine your level of risk tolerance and make investing decisions accordingly. It’s crucial to weigh prospective profits with the amount of risk you are willing to take when looking for ways to increase your wealth.

Network and Ask for Advice: Establishing a network of like-minded people, mentors, or financial advisors can offer insightful information and direction in spotting chances to increase your wealth. Being around by smart and experienced people can give you a wider perspective, assist you avoid frequent traps, and help you make wise investing decisions.

Continuous Improvement: It’s critical to continually look for ways to advance your knowledge and abilities if you want to maximize your ability to accumulate riches. This could be taking part in workshops, reading books, or attending seminars on personal finance, investment, or entrepreneurship. By making an investment in your own personal growth, you improve your capacity to spot and seize chances that could increase your wealth.

In conclusion, looking for ways to increase your wealth entails developing an investment mindset, learning about different investment options, diversifying your portfolio, maintaining a long-term perspective, comprehending risk and reward, getting guidance from reliable sources, and consistently raising your knowledge and skill level. You may improve your chances of experiencing significant financial development and creating long-term wealth by actively seeking out and taking advantage of these possibilities.

Practice Sound Financial Management

The phrase “Practise Sound Financial Management” is taken from “The Richest Man in Babylon,” and it emphasises how crucial it is to manage your money sensibly. Here are some crucial ideas to comprehend regarding this idea:

Budgeting: Making and adhering to a budget is an essential component of good financial management. With the use of a budget, you can keep track of your earnings and outgoing costs, gain insight into your spending habits, and understand where your money is going. You may allocate your income to your objectives, reduce wasteful spending, and make sure you have enough money for savings and investments by making a budget.

Distinguish necessities from Wants: Good money management requires being able to tell necessities from wants. Needs are necessary expenditures for daily existence, whereas wants are fantasies or luxuries. You can better manage your resources if you put your needs before your wants. By doing this, you can stay out of debt that is needless and make sure that your financial choices support your long-term objectives.

Debt Management: Good financial management includes having a good handle on your debt. It’s critical to distinguish between “good” and “bad” debt, which includes high-interest consumer debt that might impede your financial growth and investments in real estate or education that can produce returns.

Save and Invest: Efficient money management places a premium on saving and investing. While investing requires directing money towards building long-term wealth, saving is setting away a percentage of your salary for short-term aims. By consistently saving and investing, you may take advantage of compound interest and watch your money grow over time. You can get riches and financial independence by engaging in this practise.

Continuous learning about personal finance, investment techniques, and money management are also essential components of sound financial management. By educating oneself, whether by reading, taking classes, or attending seminars, you may make wise judgements, stay clear of frequent errors, and adjust to shifting financial conditions. You can optimize your financial management procedures and make the most of your resources by remaining informed.

Final point: Sound financial management necessitates routine evaluation and revision of your financial plans. Goals change, circumstances change, and the economy changes. You can make sure that your financial management practices are still efficient and in line with your goals by routinely evaluating your financial condition, monitoring results, and making adjustments to your tactics.

If you found this “The Richest Man In Babylon Book Summary” helpful, be sure to explore more book summaries for further inspiration and knowledge.