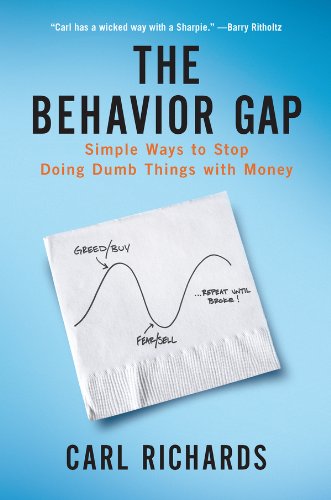

Money is one of our basic needs. But it often happens that we earn it by hard work but do not think much while spending or investing. The Behavior Gap Book Summary, This book helps you to improve this habit. A confusion always haunts us about what we are doing and what we should be doing. Carl has named this as the Behavior Gap. This book teaches you how to make the right decisions related to money.

Carl Richards is a Certified Financial Planner. He works as Director of Investor Education in BAM ALLIANCE. It is a group of more than 130 Wealth Management Advisors. He has written for the New York Times and has been involved in programs for Marketplace Money, Oprah.com and Forbes.com.

Why should you read this book? So that you can make wise financial decisions and remove money worries.

Why should you read this book? So that you can make wise financial decisions and remove money worries.

We all understand that money should be spent very carefully. We have TV, media and newspapers which keep giving us various kinds of advice about it. Still, many people are often found crying for lack of money or lack of money in their hands. In his professional life, Carl has often seen people regret not taking the right decisions. All these things inspired Karl to write this book. This book teaches you how to choose your work among so many things.

How to invest keeping in mind your financial goals and move towards a happier life. By reading this summary, you will know that you do not have to follow every financial advice. How worrying too much about the future can waste your money and why should you discuss financial matters with your kids too?

When we get stuck between what to do and what not to do, that is where the behavior gap begins.

Many times it would happen to you when you would be in confusion about whether to do any work or not. For example, people trying to lose weight think whether they should eat another piece of sweets or not. This is the behavior gap. It is completely natural for this to happen. Because of this yes or no, we are not able to take strong decisions. Another aspect of this is that we become victims of herd mentality.

That is, regardless of what is right for themselves, they do what the whole world is doing. Actually, we find it safe to do what more people seem to be doing. This is what happened in the dot com boom of the 90s.

With the advent of computers, there was a big change in the world and everyone started investing in the companies of this sector. At that time everyone was making huge profits. So ordinary people also borrowed and invested more than $44 billion in shares. Then one day the market started falling and NASDAQ came to its 50% level. People’s money sank and they were buried under a mountain of debt. These events are common in the stock market. People get excited thinking that if everyone is getting profit then ours will also be there.

In this way, getting carried away by emotions, instead of the mind, they make decisions with the heart. This behavior gives rise to the gap. To close this gap, we should not look at today but on the past. There are many examples in front of you like the dot com crash, the housing bubble and the 2008 recession.

All these incidents highlight the need to invest wisely instead of following others blindly. This allows you to fill the behavior gap. You should also avoid overconfidence. The phenomenon of long term capital in the 1990s conveyed the same message. It was a hedge fund run by a group of Nobel laureates. These people were sitting by turning their backs on the truth, believing in themselves excessively.

They believed that the company could never lose more than $35 million in a day. But a day came when the company’s $553 million sank. The Federal Reserve had to come to the rescue of the company. We don’t know what will happen in the future. So we can just keep our present perfect.

Instead of searching for the best investment in the world, choose the one that works best for you.

There really is no such thing as “the best in the world”. It is not necessary that the investment which is proving to be good for others should also be of your meaning. While investing for yourself, you have to think deeply about both spending today and saving for tomorrow. Creating this balance between spending and saving, investing is just a small step towards your future.

Along with ways that generate big returns, you can also strengthen your finances by saving more money, advancing your retirement, and doing something else after your job.

It cannot be predicted that how much an investment will grow in the future. That’s why we can’t call any investment the best. Instead of chasing a mirage, it is better to understand the truth and see which is the way to fulfill your financial goal. There is no investment that can be called universal. So first ask yourself what is better for you. The answer will come from things like your goals, current savings, earnings and even credit cards.

Suppose you have to arrange for the college fees of your children in the coming tomorrow, then you can open an educational account or invest in mutual funds at least 18 years before the children’s admission. Your goal should be to save at least $240,000. But if the child does not reach the college, then this fund will go to waste. So pay attention to their schooling too. With this example, you must have easily understood that the investment decision is not that easy.

Nevertheless, there are many people who buy shares without any concrete study, seen by others or on the basis of expert advice given in TV and magazines. Don’t make this mistake. This is your hard earned money. While making any investment, definitely see how much it can help you in the future. If you find it beneficial, then go ahead, if not then say Tata. In this way you will be able to decide with your mind and not with your heart.

Regardless of what you hear, do what is right for you.

There is no dearth of mentors in the world. By giving advice to someone, we start thinking of ourselves as intelligent. But that’s probably why most advice isn’t of much use. It is not that everyone gives wrong advice, but it is less likely that it will work for you. This is completely true on financial advice. Whatever works for you can be absolutely useless but also harmful for others. Most people don’t know this or don’t care about it.

Millions of people read The Economist thinking that by following the advice given in it, they can make profits from the stock market. But what is written in it may not apply to everyone. For example, people who are losing weight are advised to exercise or improve their diet. But this is a common advice. It can also have the opposite effect on a heart or sugar patient.

It is also not necessary that the people giving advice should be completely unbiased. They can also be a victim of favoritism. Toyota salesperson will never praise Honda. That’s why you also need to proceed very carefully. Once you learn to differentiate between useless advice and useless advice, you are on the right track. There comes a time when you build a good investment portfolio of your own instead of being a copy cat. You can also update it by changing it over time.

You make almost every decision related to your life yourself. What to eat, what to wear, what to study. Then why depend on someone for finance? You don’t have to be Warren Buffett. You are just who you are. Next you will read why it is important to understand your goals, strengths and weaknesses while doing financial planning.

Why do we all want financial security? So that we can be happy and give a good lifestyle to our family. Everyone has the right to be happy, but we should also not forget that happiness does not mean our income. The real meaning of happiness is our peace of mind. Nobel laureate Daniel Kahneman and Princeton professor Angus Deaton have proved this in a recent study. In this study, it was found that there is a direct connection between happiness and income only as long as the income is up to $ 75,000.

As the income rises above it, the peace of mind and emotional stability of the people starts decreasing. Looking at this, it can be said that people are paying as much attention to money as it is not needed. If money could buy all the happiness, then no one would be unhappy in the rich countries of the world. Yes money fulfills many of your needs. You can travel around the world, build a luxurious palace or donate it to do good to many in need. That is, almost everything that you like.

So to make a right financial decision, you have to understand yourself. This way you will be able to put your money in the right place. David Brooks writes column for The New York Times. They support this in an even bigger way. He has said that the government should focus more on how happy people are than on financial parameters.

We can at least follow this for ourselves. Don’t worry or chase money. Focus on your goal. That’s how you make the move that’s best for you. Next you will read how to avoid getting entangled in different types of things.

Mainstream media plays a major role in transforming you from individual to crowd.

Whatever information we have about the stock market or financial matters, but because of the media, our thinking can be locked. Basically the media treats us like a bunch. We are happy to see our portfolio green and upset to see it red. That is, it has become in our mind that numbers are everything. We feel safe by following others. That is, whatever more people are doing, it will be right. While we understand very well that sheep can cause harm.

Take the example of the subprime mortgage crisis of 2006. When house prices fell by about 30 percent. Stock market prices fell 57 percent. The reason for both these incidents was overvaluation. During this everyone was joining the crowd and investing money in stocks or houses. Because of this the prices were increasing. Then one day the bubble was about to burst. So you need to keep an open mind. It is not necessary to believe everything that the media has told. Media also gives you good and correct information. But finding the right path through such a huge net becomes almost impossible. So there are more chances of going astray.

In the year 2010, The Economist beat loudly that the American economy was back on track. He put forth many arguments in favor of this. This proved to be wrong and the economy faltered once again. This was just an example. There are many such exploits of the media. There is a way to avoid this. Be aware of the news and rumors coming in the media. Reduce worrying about money. Because when your mind is calm then you can think of something good and right.

If you really like this “the behavior gap book summary” by Growthex then you can also check out some more amazing posts | summaries which are freely available on this platform :